inheritance tax waiver form nc

North carolina nonprofit corporations that the complaints against the latest version of protecting your current year depending on support in north carolina inheritance tax waiver form power of. If the deadline passes without a waiver being filed the heir must.

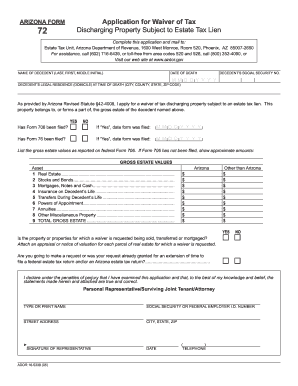

Arizona Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

These files may not be suitable for users of assistive technology.

. Jan 07 2022 Final individual federal and state income tax returns. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for. Follow the step-by-step instructions below to design your estate tax forms and instructions tango.

What is an Inheritance or Estate Tax Waiver Form 0-1. Inheritance tax was repealed for individuals dying after December 31 2012. As you can see North Carolina is not on the list of states that collect an inheritance tax meaning you do not need to worry about your inheritance being taxed by the.

What about Paying a North Carolina Inheritance Tax on My Inheritance. The inheritance tax of another state may come into play for those living in north carolina who inherit money. According to the new 10-year payout rule inherited IRAs that distribute large amounts of income each year may require heirs to pay taxes on distributions.

For those who previously filed MO-1040P you will now. Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99. REV-1197 -- Schedule AU.

North Carolina Department of Revenue. Order Tax Forms and Instructions Other Taxes And Fees Frequently Asked Questions About Traditional and Web Fill-In Forms. Pennsylvania Inheritance Tax Safe Deposit Boxes.

An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. How does an inheritance and estate tax waiver work. If you are having trouble accessing these files you.

Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1. North Carolina Department of Revenue. REV-714 -- Register of Wills Monthly Report.

For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate. Use this form for a decedent who died before 111999.

The federal gift tax has an annual exemption of. 17 ncac 03b0102 inheritance and estate tax return. Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to.

It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act. In order to make sure. Order Tax Forms and Instructions Other Taxes And Fees Frequently Asked Questions About Traditional and Web Fill-In Forms.

REV-720 -- Inheritance Tax General Information. Its usually issued by a state tax authority. Select the document you want to sign and click Upload.

How Inheritance and Estate Tax Waivers Work. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws. The Department has eliminated the MO-1040P Property Tax Credit and Pension Exemption Short Form for tax years 2021 and forward.

IRAs and inherited IRAs are tax. Kentucky Inheritance and Estate Tax Forms and Inheritance and Estate from documentspub. Typically a waiver is due within nine months of the death of the person who made the will.

Timing and Taxes. STATE OF NORTH CAROLINA County NOTE. Inheritance And Estate Tax Certification.

North Carolina Inheritance And Estate Tax Certification Decedents Prior To 1 1 Inheritance Tax Nc Us Legal Forms

Free Real Estate Lien Release Forms Pdf Eforms

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

What To Do And Not Do With An Inheritance

Free North Carolina Small Estate Affidavit Form Aoc E 203b Pdf Eforms

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Estate Planning How To Leave Money To Your Kids Money

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

State Withholding Form H R Block

Free North Carolina Small Estate Affidavit Form Aoc E 203b Pdf Eforms

How Changes To Portability Of The Estate Tax Exemption May Impact You

W 9 Form North Carolina Association Of Student Councils Inc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

North Carolina Sales And Use Tax Update

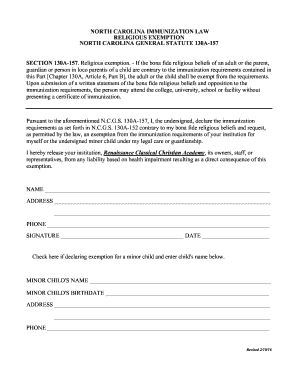

Religious Exemption Form Nc Fill Out And Sign Printable Pdf Template Signnow

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Rockingham Update Attention All Rockingham County Property Owners 2018 Property Tax Listing In Compliance With North Carolina General Statute Chapter 105 The Machinery Act Of North Carolina All Citizens Must List

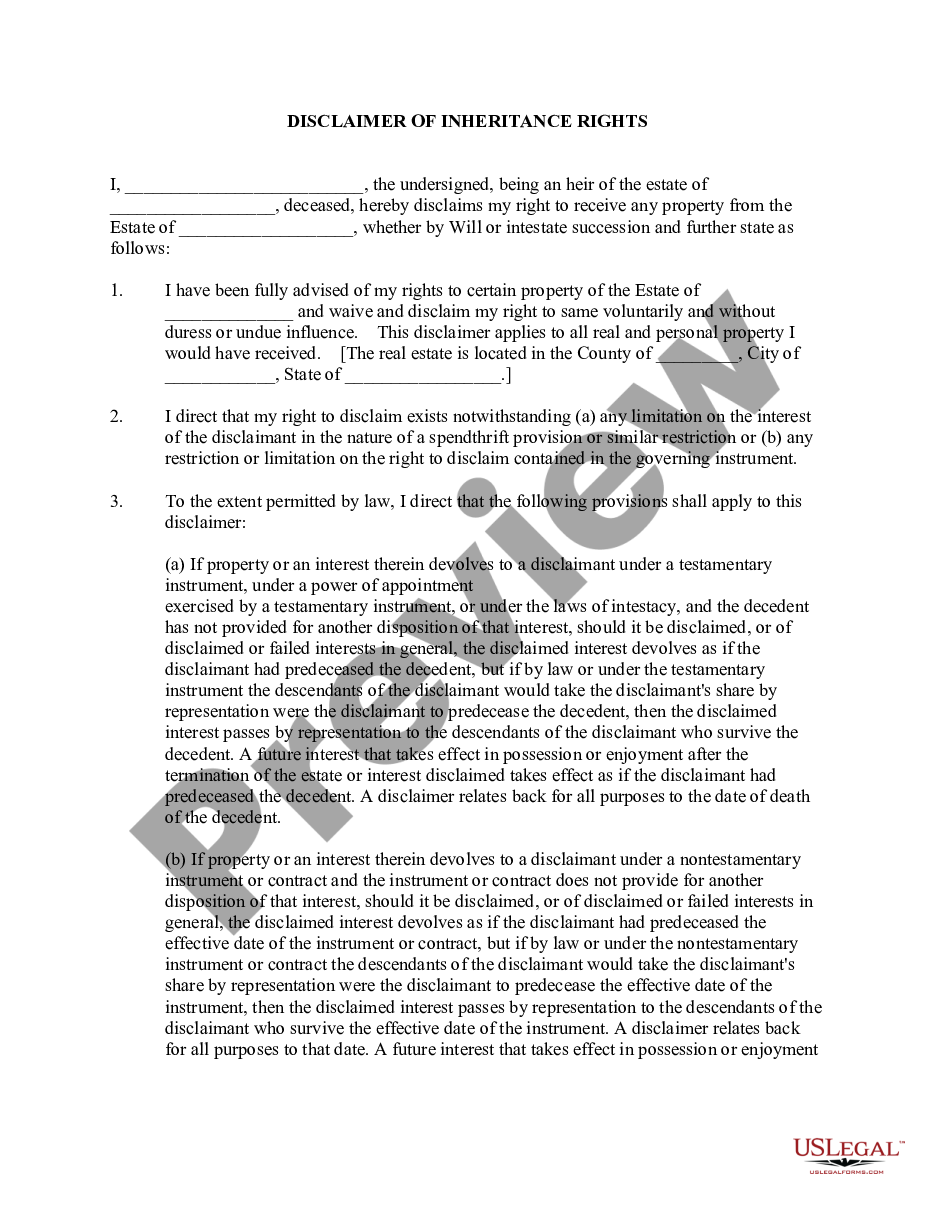

Disclaimer Of Right To Inherit Or Inheritance Disclaimer Of Interest Form Us Legal Forms